By Nikki Johnson, Regional Economist

In July, overseas arrivals to the United States declined 3.1% from the prior year, the third consecutive monthly drop. Even with softer international travel and easing consumer confidence, the leisure and hospitality sector has remained resilient. Nationally and in Hampton Roads, employment continues to gain ground, and while hotel indicators are cooling at the national level, local performance remains firm.

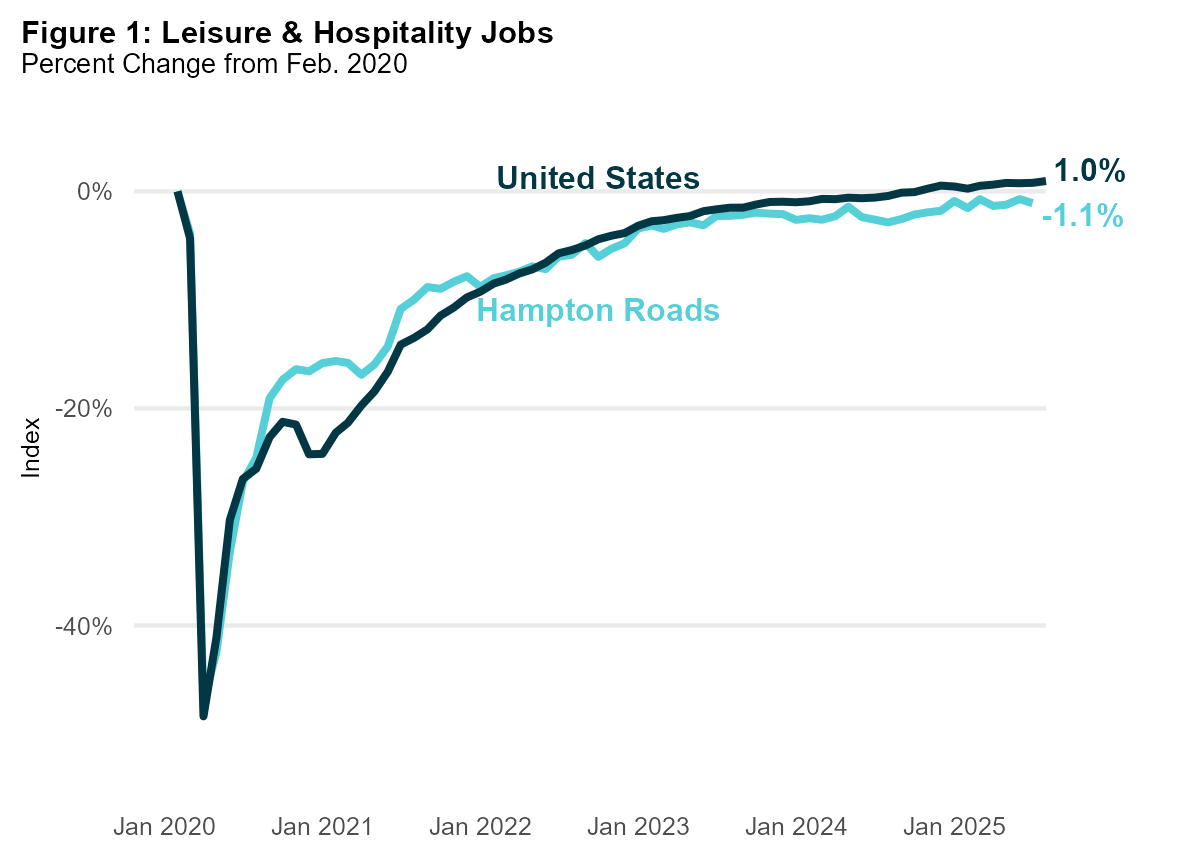

The leisure and hospitality sector was among the hardest hit during the pandemic and one of the slowest to recover. Figure 1 tracks sector employment since February 2020. At the national level, jobs in this sector finally surpassed their pre-pandemic mark in late 2024, nearly four years after the initial shutdowns. As of August 2025, national leisure and hospitality employment stands 1.0% above February 2020 levels. Job growth has moderated from the sharp rebound of 2022 and 2023 but is now pacing in line with the levels seen prior to the pandemic.

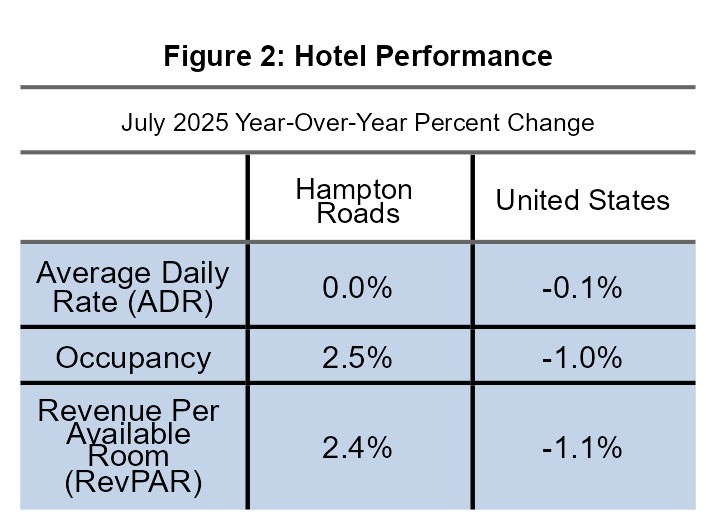

In Hampton Roads, the recovery has been slower. The region rebounded quickly after the summer of 2020 as leisure travel surged back, but since 2023 the pace of job gains has lagged behind the nation. As of July 2025, Hampton Roads leisure and hospitality employment remains 1.1% below pre-pandemic levels observed in February 2020. Still, momentum in 2025 has been positive: the region has added jobs year-over-year every month through July, with employment up 0.3 percent so far this year.While jobs remain steady, hotel performance offers a more nuanced picture. STR data show that the national hotel market has softened in recent months. In July 2025, occupancy rates slipped 1.0 percent from the prior year to 68.2 percent. The average daily rate (ADR) edged down 0.1 percent to $161.90, while revenue per available room (RevPAR) declined 1.1 percent to $110.37. Year-to-date results are somewhat firmer, with RevPAR up slightly, but the July numbers underscore a cooling trend.

|  |

Data Sources: Bureau of Labor Statistics, Costar, Hampton Roads Alliance and HRPDC. Hampton Roads reflects the Virginia Beach-Chesapeake-Norfolk, VA-NC MSA.

|

Hampton Roads hotels have fared better. As shown in the table above, regional hotel performance indicators were positive in July relative to the prior year. Occupancy rose 2.5%, ADR was steady, and RevPAR increased 2.4%. This stands in contrast to the national declines across all three measures. Compared with Virginia as a whole, Hampton Roads posted stronger occupancy gains, reflecting continued resilience in leisure demand.

International arrivals have been constrained by macro-policy changes, slowing inbound tourism to the nation. Hampton Roads, by contrast, relies more on domestic leisure travelers. As a result, the region has experienced less drag from the international slowdown. Tourism remains an important contributor to the Hampton Roads economy, and the latest data show a sector holding steady.

Read More and Economic Indicators