Shipbuilding & Repair

By Nikki Johnson, Regional Economist

The budget reconciliation bill signed into law last week includes $29 billion for shipbuilding and repair. The funding will support the construction of new Navy ships, upgrades to shipyard infrastructure, workforce development, and subsidies for commercial vessel production. This spending is in addition to the $20.8 billion proposed in the Pentagon’s base budget for shipbuilding and repair in fiscal year 2026. These investments, along with other recent legislative initiatives, reflect a broader federal effort to rebuild the U.S. shipbuilding industrial base, a sector where Hampton Roads plays a central national role.

Much of the recent urgency stems from China’s rise as the dominant player in global shipbuilding. China produces roughly 1,700 vessels annually, compared to about five in the United States. That commercial capacity has supported military expansion, as shared infrastructure and supply chains enable more rapid and cost-efficient naval production. China now fields more total warships than the United States. While the U.S. fleet remains more technologically advanced, its limited industrial capacity has become a growing national secuirty concern. U.S. shipbuilding output has declined for decades. Since the 1980s, the U.S. share of global shipbuilding has remained below 1 percent, down from about 5 percent in the 1970s. Today, most large U.S. shipyards focus on Navy contracts and a small number of Jones Act vessels for domestic trade.

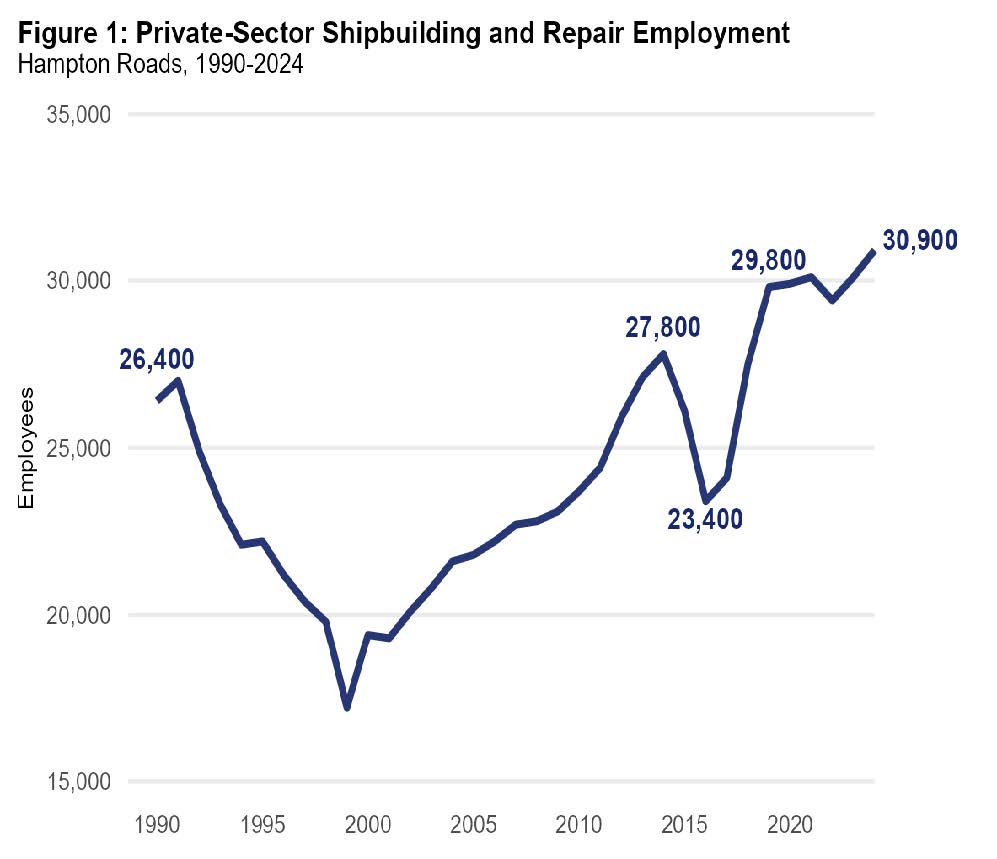

Hampton Roads is home to Newport News Shipbuilding, the only U.S. yard building nuclear-powered aircraft carriers and one of two constructing submarines for the Columbia- and Virginia-class programs. The region also hosts Norfolk Naval Shipyard, one of four public naval yards, and a network of private repair firms, suppliers, and maritime training programs. More than one in five U.S. workers in shipbuilding and repair are employed in Hampton Roads. As shown in Figure 1, shipbuilding and repair employment in the region reached 30,900 in 2024, the highest level in more than three decades. From 1990 to 2024 shipbuilding employment in the nation was down 13.4%, compared to a 17.0% increase in the region.

Data Sources: Census County Business Patterns, Bureau of Labor Statistics (CES), and HRPDC. Hampton Roads reflects the Virginia Beach-Chesapeake-Norfolk, VA-NC MSA.

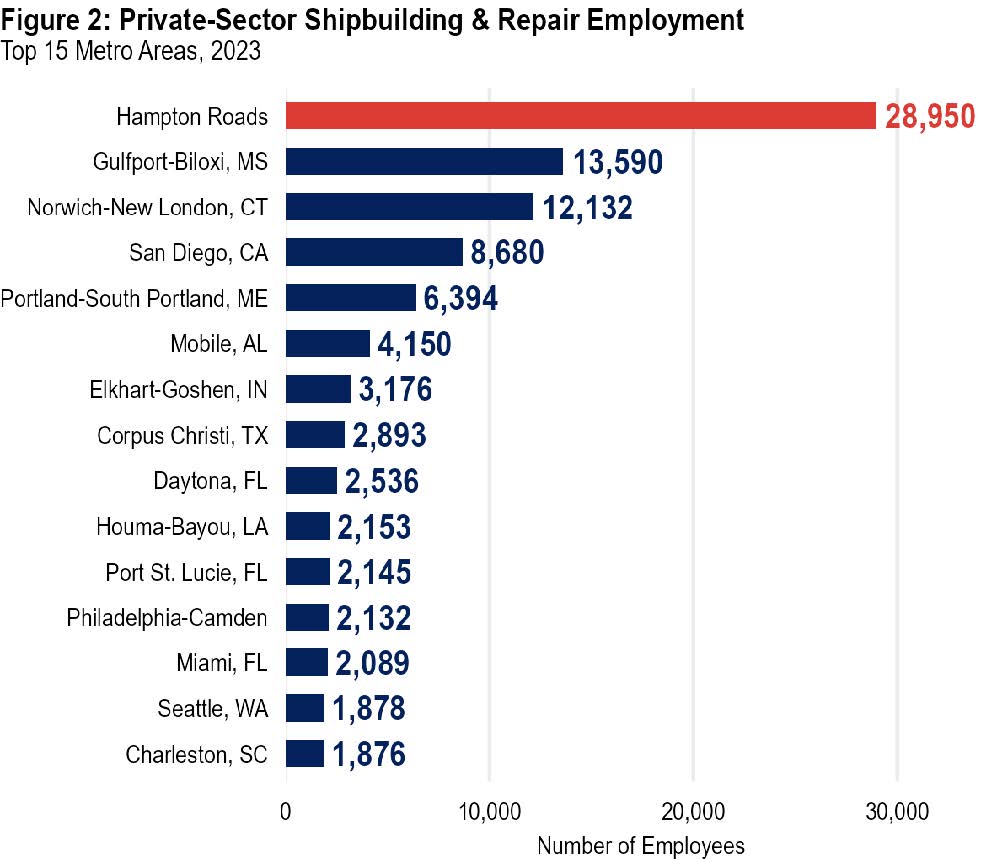

Nearly half of all shipbuilding and repair employment is now located in the five largest shipyard metros. Hampton Roads tops that list. As shown in Figure 2, the region’s private shipbuilding workforce is the largest in the country, more than the next two largest metro areas combined.

Sustaining that position will depend on continued investment in both infrastructure and workforce. Hampton Roads has an established talent pipeline that spans the full spectrum of maritime trades and technical skills, supported by long-standing partnerships across industry, labor, and education. As federal investment scales up, the region’s

Read More and Economic Indicators